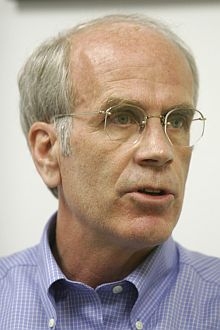

Congressman Peter Welch flew back to Vermont Monday after voting

"no" on the $700 billion Wall Street bail out plan that failed to pass

the House by a small majority. We’ll talk with him about the debate

raging in Congress over how to solve the economic crisis. (Listen)

Also on the program, we’ll look at what’s

behind the disappointing results on Vermont’s first statewide school

science assessment.Are Vermont students learning the science they’ll need for the 21st century? We’ll talk about how science is taught in Vermont, and about efforts to improve the science education statewide. Our guests are Pat Fitzsimmons of the Vermont Department of Education and award-winning science teacher Bill Eschholz of Mount Mansfield Union High School.(Listen)

AP Photo by Toby Talbot

Comments

Thank you for voting against the bailout. This is probably the most significant issue we’ve seen in the last 7 years, if not in the last 80 years. The leadership has made it clear that they intend to try again. Let the large national banks fail. Vermont banks have been very careful in their lending policies and face virtually no exposure from the sub-prime lending crisis. In addition, those banks and other institutions that engaged in poor credit transactions deserve to fail. Why are we focused on purchasing bad debt from deadbeat financial institutions? If there is going to be $700 billion spent, spend it on individuals, not on large financial institutions.

If there’s $700 billion available, think of the safety net for individuals and infrastructure investment we can make in the country and the State of Vermont. Spend that money on roads and bridges. How about schools and libraries? Healthcare? Alternative energy? Mortgage subsidies for precarious borrowers?

Think of the incredible good we can do with that money providing new jobs, maybe new industries and new paradigms of thinking. Senator Obama is right. We need change. I think the change we need, though, is significantly more radical than he might be thinking. The change we need is a change of focus. Let’s begin to focus, not on large institutions, but on individuals. Make their lives better. Forget the corporate fat-cats. Make the lives of middle and lower income people better. Less stressful. Give them jobs and healthcare and a guaranteed education for their children with promise. Invest in them,

not Corporate America. The bailout is just another version of trickle-down economics. When Speaker Pelosi comes to you, and she will, and twists your arm, please don’t say Uncle.

Again, thank you for your vote on Monday.

Sincerely,

Rob, Rutland

Why not have the Government purchase part of mortgages to keep people in their homes and absorb some of the losses on lender balance sheets to stabilize the banks, this should stabilize the derivitives that are based on shaky mortgages

without giving a blank check to Paulson or Wall Street?

We need to not give Paulson the power to hand out money to his friends. We don’t just need to look at this after the fact, we need to have non-partisan organization that authorizes any payouts.

Tom, Warren

Wasn’t this administration trying to get Wall Street to take care of

Social Security? Just curious

Martha, Rygate

I am a longtime, strong democrat, way back to the days of Phil Hoff and I have been impressed with Mr. Welch’s first term…until now. He has made a huge error voting against this bill. Unfortunately many of my neighbors feel this is a bailout of Wall street. It is not, rather it a rescue of our entire banking system. It is Mr. Wech’s job as well as his leadership’s to educate the his contituents about this crisis. He needs to ignore his misinformed constituents (or educate them) and vote yes when this bill is re-introduced. He can reform the Banking industry next week…

John, Rupert

I am actually writing to primarily make 2 statements:

1. Jane Lindholm’s interview with Peter Welch was excellent. She asked

appropriate questions in a very civil manner. Civility is an important aspect

generally missing in dialogue today,

2. I strongly disagree with Peter Welch’s vote (not a profile in courage) and

I’ve emailed him and informed him he’s lost my vote.

Now a few details…I’m a life long liberal democrat…but my philosophical roots are with the FDR, Truman and John Kennedy wing of the party.

It’s interesting that, in general, it was the "liberals" and "conservatives"

that voted no on this "Bailout" or "Rescue". It was the middle of the road

representatives that stepped in and were willing to get their hands dirty to

help (note I said help) solve our problems.

The left and the right try to be too pure within their narrow philosophy. There

are many gray areas that need to be acknowledged. We need to compromise. Mr. Welch’s homepage states that…he didn’t believe the plan would work so he voted no. How much financial pain does he need to see? Did Mr. Welch offer a formal plan since he knew all the time he would vote no? Did Mr. Welch vote no because he in fact expected the bill to pass, thus he could escape any fallout or responsibility?

Again, no profiles in courage for Mr. Welch.

Sincerely,

Stephen, So. Burlington

I want to express my gratitude to Congressman Welch for voting against the bail out. As he said in his interview, years of fiscal irresponsibility cannot be solved with a simple act of congress. I thank him for taking a step back and providing time for alternatives to be considered. I believe that ordinary Americans will be worse off if we pass this bill because of it’s effect on inflation and the deficit. The economy has to take the hit sometime. What the Fed has created with its years of manipulation is artificial and cannot last.

Jesse

I was disappointed that Rep. Welch did not answer Jane’s question about whether he supported Bernie Sanders’s proposal to pay for the bailout by a tax on the wealthy. Is this proposal Bold Bernie at his Best or is it demagoguery, and if so, why? We deserve to know one member of our delegation’s view on the proposal of another.

Rebecca, South Strafford

I was on the fence on this one; I resisted appeals from my friends to phone Peter’s office and urge him to vote "no." But I’m glad he did. After eight years (and more) of kleptocracy, we need to get some grownups in charge of our national economic and political life. Americans are too addicted to instant gratification and instant solutions: better to step back, look at the mess, and take some reasonable steps to start cleaning it up — and making sure we don’t have another one to deal with in another decade.

I believe the Republicans wanted to shift the blame for this debacle to the Democrats, so it’s just as well it didn’t happen — yet.

Linda, Enosburg Falls,

I did not vote for Congressman Welch; however, I am so glad right now that he won the race for he has done the right thing with this "bail out" of Wall Street. He and Ben Stein, a conservative, should team up and write the legislation for the bail out. They both use common sense and acknowledge that we have to solve the problem, not just throw money at it. My 401 k was devasted this morning but it will be worse in the long run if the root of the problem is not corrected. PLEASE DO NOT GIVE THE MONEY TO PAULSEN OR BERNAKE! They never saw this mess coming and if they did, they did nothing about it. They have shown they are not the financial gurus they claim to be.

Giving $700 billion (I cannot really conceive what that amount is except I know my great grandchildren will be paying for it) to one or two people who want me to trust them to use it wisely is ridiculously ignorant. There are no checks and balances in the current system that is why we are in the mess we are in. The market was overpriced for a very long time and the short sellers and hedgefund players took advantage of our ignorance and our laziness in asking "Hey, what’s going on here?" Now we will have no one to blame but ourselves if we panic and pass legislation that does not address the fundamental underlying problems that have been years in the making. We cannot correct those with a $700 billion magic wand. What happens when the next crisis hits – where will we go then? Thank you Congressman Welch for putting on the brakes and taking time to look before we leap.

Lynda, Vernon,

VTFrom the failed legislation

WHAT DOES THE FOLLOWING REALLY MEAN?

"in determining whether to engage in a direct purchase from an individual financial institution, the long-term viability of the financial institution in determining whether the purchase represents the most efficient use of funds under this Act;"

How can anyone reasonably asses this in a panic

Is the following all the protection the taxpayer gets?

1 (1) protecting the interests of taxpayers by

2 maximizing overall returns and minimizing the impact on the national debt;

Who are the ones actually capable of doing this?

IN THE Emergency Economic Stabilization Act of 2008 The proposal was to place proceeds in the General Fund. Social Security, foe rexample(as I understand it) is in the General Fund… except it ISN’T really there… So, in the end, with something closely resembling "TARP" there would be nothing but more debt for the American Taxpayer.

Our country continues to run deficits and there is no way that buying worthless assets (deriviatives and mortgage backed securities) will provide funds to offset 700 billion dollars of additional debt.

Much work needs to be done. Congress should take its time.

Mike, Hartland

While the market drop had a negative impact for me personally, I applaud Congressman Welch for his courage in opposing the legislation.

Steve, Barre

INTO JAIL … NO BAIL-OUT It becomes clearer with each passing day that Washington is ready to rob Main Street to rescue Wall Street. To the professional career politicians, this is merely business-as-usual: privatize profit and socialize loss. Only we the people can prevent this, and we have the power and the tool. Uncle Sam says unless we bail out the gamblers and thieves at their bum’s rush speed, they may have to curtail or eliminate "entitlements": their new name for Social Security, Medicare, interest on Treasury bills,notes and bonds, FDIC guarantees on bank accounts, and other fixed federal obligations. What can we, and only we the people, do to prevent this?

Create a Vermont TAX FORWARDER office to collect Vermonters’ federal tax payments and to pay Social Security, Medicare, Treasury interest, FDIC guarantees, and any other fixed federal obligations and then forward the rest, if any, to IRS. The individual and business tax payer will file his 1040 with IRS as usual, but instead of a check, he/she will attach a tax forwarder certification that the tax due is on deposit in the state treasury until federal obligations have been paid in full, and any balance will be paid to IRS by the Tax Forwarder right after individual taxpayer claims have been paid.

Before any bailout discussions, pause until the completion of the FBI investigation of crimes in the course of this mess, and restitution from the beneficiaries of the threatened melt-down may reduce or eliminate the need for a $700-billion heist. The heist beneficiaries should be jailed for indefinite terms until they coughed up the loot, wherever they hid it. Once restitutions are in, we are entitled to a detailed and credible accounting of how the final bail-out amount will affect tax payers in various brackets.

But would it be constitutional to do this? On July 4, 1776, the Second Continental Congress unanimously codified the Declaration of Independence. It states, in relevant part: "….deriving their just Powers from the Consent of the Governed…" The currently pending "urgent" Paulson/Bernanke proposal to bail out the financial institutions with a $700-billion tax heist, to be raised from U.S. taxpayers, does not meet this constitutional requirement. The bum’s rush urgency of the Bushmen shows their fear of anybody examining, or even debating, this outrageous rip-off.

There are a few other suggestions we should implement in codified federal law with ample enforcement provisions, to comply with the Consent of the Governed provision. We need a federal "Initiative, referendum, and recall" law, on motion of any tax payer, and seconded by another tax payer. California has a good IR&C provision but it takes millions to circulate a recall petition.

The presidential veto override should be by the national electorate, not the unrepresentative politicians, and if successful, should include the automatic recall of the incumbent vetoing official.

In the meantime, Washington should establish a list of meltdown threatened institutions in decreasing order of threat, and dig moats around them to prevent a deluge in the unlikely event of any meltdown.

We should close Wall Street for five years and see if used stocks and bonds cannot be better traded like used homes and used cars. This will extinguish insider traders and other speculators, and will provide gambling addicts the opportunity to gamble in Atlantic City and Las Vegas, at no cost or risk to honest citizens.

If elected, I pledge to organize support to implement the Vermont-based proposals, and expect most if not all other states to follow our example. If not elected, I will merely advocate my suggestions to the best of my ability.

Peter Moss, Fairfax

(Peter Moss of Fairfax is a candidate for the Vermont State House)